Have you ever watched someone make a drastic, expensive life change at 45 and wondered if there was a smarter way to navigate that transition?

The concept of a midlife crisis often conjures images of impulsive sports car purchases or radical career shifts. However, what if this period of reevaluation could be anticipated and managed with financial foresight? The key isn't to avoid the introspection that comes with middle age, but to ensure it doesn't derail your long-term security. By learning how to create your midlife crisis fund strategically, you build a financial airbag for life's unexpected emotional collisions.

Understanding the Midlife Transition

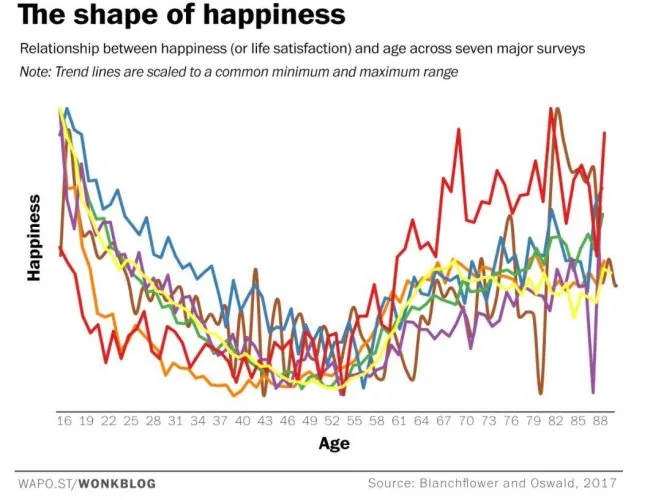

Contrary to popular belief, a midlife crisis is less about a single dramatic event and more about a gradual accumulation of realizations. Research suggests this period, typically between ages 40 and 60, is a normative developmental stage involving significant psychological recalibration (Harvard, 2024). It's a time when people assess the gap between their youthful aspirations and their current reality.

The triggers are varied but predictable: career plateaus, children leaving home, caring for aging parents, or confronting one's own mortality. A study on adult development notes that this phase is often marked by a search for renewed purpose and meaning (Mayo Clinic, 2023). Financially, this search can manifest in ways that threaten stability if not planned for.

Beyond the Stereotype

While the cliché involves red convertibles, modern manifestations are more nuanced. Consider the executive who, after 20 years in corporate finance, feels compelled to leave and start a boutique vineyard. Or the parent who, after their last child goes to college, decides to fund a year of global travel to "find themselves." These aren't frivolous whims but deep-seated needs for change that carry significant price tags.

Another common, less-discussed example is the "legacy project"--suddenly investing large sums into a passion business with more emotional than financial ROI, like opening a bookstore or a microbrewery. Without a dedicated fund, these ventures often pull from retirement savings or create unsustainable debt.

Why a Dedicated Fund Is Crucial

Emotional spending during times of transition follows predictable patterns. The brain's reward centers light up when making purchases that symbolize freedom, youth, or a new identity. This neurochemical response can override rational financial planning. A dedicated fund acts as a pre-negotiated boundary with your future self.

Separating this money from your emergency savings or retirement accounts is psychologically powerful. It acknowledges the validity of your future emotional needs without compromising your essential safety nets. Think of it as a create your midlife crisis allowance--a sanctioned space for exploration.

Financially, this compartmentalization prevents the domino effect where one impulsive decision bleeds into others. For instance, taking a six-month unpaid sabbatical to write a novel shouldn't mean halting your 401(k) contributions or tapping into your home's equity.

How to Create Your Midlife Crisis Fund

Building this buffer requires a shift from vague intention to specific strategy. Start by defining what "crisis" spending might look like for you. Is it funding a career transition course? A restorative solo trip? Supporting a new creative endeavor? Quantify these potential needs.

Step 1: Set a Target Amount

Unlike retirement savings, this fund has a shorter horizon and a more defined purpose. Aim for an amount that covers 6-12 months of discretionary "reinvention" spending without touching core assets. For many, this ranges from $30,000 to $100,000, depending on lifestyle and aspirations.

Step 2: Choose the Right Vehicle

This money should be relatively liquid but separate from your daily accounts. Consider a high-yield savings account or a conservative brokerage account. The goal isn't aggressive growth but preservation with modest returns. Automate contributions just as you would for retirement--treating it as a non-negotiable expense.

Step 3: Timeline and Discipline If you're 35 now, giving yourself a 10-year runway to build this fund allows for steady, manageable contributions. The act of consistently funding it serves a dual purpose: it builds the financial resource while reinforcing the mindfulness about this future life stage.

Real-World Examples and Strategies

Let's move beyond theory. Here are practical ways people successfully create your midlife crisis fund without straining their current finances.

The Side-Hustle Siphon: Designate all income from a freelance gig, rental property, or side business to flow directly into this fund. This creates a psychological separation from your primary income and can accelerate savings meaningfully.

The Windfall Warehouse: Commit bonuses, tax refunds, or inheritance money to this account. These lump sums can build the foundation quickly. One couple used an unexpected inheritance to fully fund their "next chapter" account, giving them peace of mind for a planned career downshift at 50.

The Expense Swap: As you pay off debts (like a car loan or student loans), redirect those monthly payments into your crisis fund. You're already accustomed to not having that money, so the savings happen painlessly.

What If the Crisis Never Comes?

This is the beautiful paradox of preparedness. By building this fund, you engage in proactive financial and emotional planning that often mitigates the severity of the crisis itself. The fund becomes a symbol of agency.

If you reach your target age and feel content and stable, the money doesn't vanish. It simply transforms into a "second act" fund. This capital can be repurposed for:A spectacular family milestone celebration or legacy tripSeed funding for a passion project in early retirementAn enhanced education fund for children or grandchildrenA major home renovation that brings lasting joy

The process of learning how to create your midlife crisis fund cultivates financial resilience that benefits all areas of life. It's the practice of funding your future self's dreams, whatever form they take.

Integrating With Your Overall Financial Plan

This fund should not exist in isolation. It's one component of a healthy financial ecosystem that includes retirement accounts, emergency savings, and investment portfolios. The hierarchy is clear: first secure necessities, then build for known future needs (retirement), and finally, allocate for emotional and transitional needs.

Regular check-ins are essential. As life circumstances change--a promotion, a child's college acceptance, an aging parent's needs--reassess the purpose and target of this fund. It should be a living part of your financial plan, not a set-it-and-forget-it account.

Consider consulting with a fee-only financial planner to help position this fund within your broader asset allocation. They can provide objective guidance on appropriate funding levels and account types based on your complete financial picture.

The Ultimate Financial Acts of Self-Care

In the end, learning to create your midlife crisis fund is about more than money. It's a profound act of self-awareness and self-compassion. It acknowledges that you will change, that your needs will evolve, and that providing for your future emotional well-being is as important as providing for your physical needs.

This preparation transforms a potential period of panic and impulsive decisions into a chapter of intentional exploration. It grants you the freedom to ask big questions without the looming fear of financial ruin. By building this bridge to your future self, you don't just protect your wealth--you invest in your continued growth and fulfillment.

Start today, not with anxiety about an impending crisis, but with the confidence that comes from thoughtful preparation. Your future self will thank you for the grace and space you've created.