In an economic landscape often characterized by shifting sentiments and unpredictable markets, understanding where genuine opportunity lies is paramount for astute investors. While high mortgage rates and persistent inflation concerns might suggest caution, a compelling counter-narrative is emerging for the residential commercial real estate sector. This article delves into *why residential commercial real* estate presents a unique and attractive investment proposition in 2025, drawing insights from industry experts like Ben Miller, co-founder and CEO of Fundrise, who maintains an optimistic outlook based on several key market indicators.

The Valuation Disconnect and Market Realignment

One of the most significant arguments for residential commercial real estate's appeal in 2025 stems from a pronounced valuation differential between public equities and private real estate. The S&P 500, for instance, has been trading at a forward earnings multiple significantly above its historical average, often signaling potential for future lackluster returns (Financial Analyst Projections, 2024). This stands in stark contrast to commercial real estate prices, which have seen declines exceeding 20% in the past two years, even as stock markets experienced substantial rallies.

This wide valuation gap creates an intriguing opportunity for value investors. Historically, stocks and commercial real estate have exhibited a strong correlation, moving in tandem with the broader economy. However, this correlation has notably broken down since 2022. This divergence suggests a potential for mean reversion, where real estate could see significant upside as its valuation catches up, especially if mortgage rates begin to ease. Consider the market reset after the dot-com bubble, where undervalued sectors eventually saw robust rebounds, a parallel that could play out in today's real estate market (Harvard Business Review, 2002).

Many apartment values, for example, have receded to levels reminiscent of the Global Financial Crisis. Yet, today's economy boasts stronger household balance sheets and more robust underlying fundamentals than during that period. This disconnect makes a strong case for *why residential commercial real* estate, particularly multi-family properties, is poised for a rebound similar to the sharp recovery observed post-2008.

The Looming Undersupply of Housing

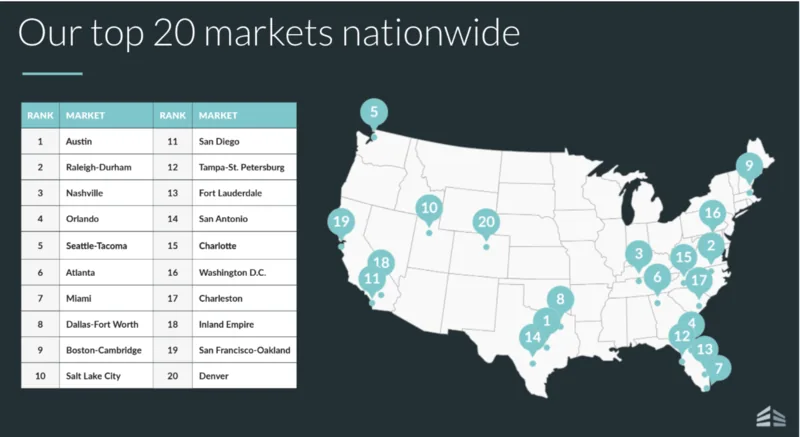

Another powerful driver for the optimistic outlook on residential commercial real estate is the developing undersupply of housing. Elevated interest rates over the past few years have dramatically slowed new construction across the nation. This slowdown is not confined to a few locales; even historically builder-friendly cities like Austin and Houston have seen new housing starts plummet. Costar data indicates that new housing starts in Houston are down by an astonishing 97%.

This multi-year pause in development is setting the stage for a significant housing shortage. Experts project that the oversupply from the building boom through 2021 will be absorbed by the end of 2025, if not sooner. This rapid absorption means that demand will soon outstrip available supply, leading to upward pressure on rents and property values. For instance, cities like Nashville and Phoenix, which saw rapid growth and construction in the past decade, are now experiencing considerable slowdowns in multi-family unit permit applications, signaling a future tightening of rental markets (National Association of Home Builders, 2024).

While some argue that a full return to office could bolster commercial real estate in major urban centers, others remain skeptical, citing technological advancements and evolving work preferences. Nevertheless, the fundamental imbalance between housing supply and demand is a compelling reason *why residential commercial real* estate is positioned for growth, especially as existing portfolios are already reporting renewed rent growth.

Inflationary Outlook and Long-Term Trends

Concerns about accelerating inflation, particularly in a potential new presidential term, are valid but might be overstated in the context of residential real estate. Historical data shows that even during periods of robust economic growth and significant policy changes, inflation remained relatively contained until the unique circumstances of the pandemic. Pledges to combat inflation from political leaders also suggest a policy focus that could prevent runaway price increases.

Furthermore, long-term demographic trends point towards a deflationary environment. America's declining birth rate translates to slower population growth, which inherently exerts downward pressure on inflation over time. This demographic shift, combined with the Federal Reserve's anticipated rate cuts starting in late 2025, creates a more stable economic backdrop conducive to real estate investment. The market widely expects the Fed to cut interest rates by at least 100 basis points over the next year, signaling the potential end of the commercial real estate recession.

The rise of remote work has also shifted demand patterns, creating new opportunities in secondary and tertiary markets for residential rentals, further diversifying investment potential beyond traditional urban cores (Pew Research Center, 2023). This adaptability of residential commercial real estate to evolving societal trends reinforces its long-term appeal.

Strategic Allocation for 2025 and Beyond

For value investors, the current market presents a rare disconnect in historical performance and valuations. After the S&P 500's robust performance in 2023 and 2024, the likelihood of similar outsized returns in 2025 appears diminished. Consequently, allocating new investment capital to undervalued residential commercial real estate, rather than expensive stocks, becomes a compelling strategy.

This strategic shift allows investors to capitalize on tangible assets that generate income and provide essential utility, serving as a hedge against market volatility. Platforms like Fundrise make dollar-cost averaging into commercial real estate accessible, even with low investment minimums, broadening participation in this potentially lucrative sector. The confluence of a valuation reset, a looming housing undersupply, and a stable long-term inflationary outlook firmly positions *why residential commercial real* estate should be a cornerstone of diversified portfolios in 2025 and beyond.