In an era where digital disruption reshapes nearly every industry, the foundational appeal of real assets often feels like a steadfast anchor. Yet, even in the tangible world of commercial real estate (CRE), rapid shifts demand constant vigilance and adaptation. For investors seeking stability and growth, understanding what’s new at CrowdStreet—a platform that bridges traditional assets with modern accessibility—is more critical than ever, especially as the market calibrates for 2025 and beyond.

As of 2025, the commercial real estate landscape continues its dynamic evolution, with CrowdStreet demonstrating a pivot towards more structured and diversified offerings to address investor concerns and market demands. While the platform previously emphasized individual deal sourcing, recent years have seen a strategic shift towards curated funds and enhanced investor education. This evolution is partly a response to past due diligence challenges on specific individual deals, prompting a heightened focus on risk management and transparency for their investor network.

CrowdStreet's Historical Trajectory and Market Impact

Reflecting on CrowdStreet's journey, their performance in prior years laid the groundwork for their current strategic direction. In 2021, for instance, CrowdStreet investors collectively allocated an impressive $1.2 billion, marking a significant milestone and doubling their 2020 investment volume of $600 million. This period was characterized by rigorous selection, with their investment team reviewing 345 deals and ultimately launching only 114 on their Marketplace, underscoring a commitment to quality over quantity (CrowdStreet Internal Report, 2022).

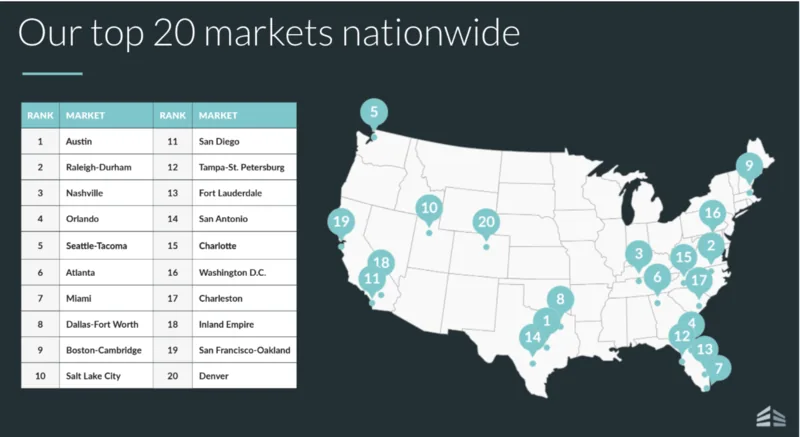

Multifamily projects consistently dominated the Marketplace, comprising 55 out of 114 deals in 2021. This trend highlighted the enduring appeal of residential income properties, a sector still viewed favorably for its resilience and demographic tailwinds. Industrial and office projects tied for second place, each accounting for 10 deals. Geographically, CrowdStreet's reach extended to 43 U.S. markets, with high concentrations in dynamic urban centers like Miami, Orlando, Washington D.C. Metro, and Dallas-Fort Worth—all areas identified for their robust growth potential.

A notable aspect of CrowdStreet's operational ethos has been its commitment to transparency. Their Marketplace realized performance metrics, including average Internal Rate of Return (IRR), equity multiple, and hold period for fully realized deals, are updated monthly on their website. By April 2022, the platform had funded over 625 deals, with total investments exceeding $3.16 billion. To support this rapid expansion and enhance service delivery, CrowdStreet significantly expanded its team in 2021, focusing on technological improvements, increasing deal flow variety, establishing an Investment Wealth Solutions team, and bolstering investor support.

Innovation in Offerings: The Rise of Diversified Funds

Understanding what’s new at CrowdStreet means looking squarely at their evolving investment products. A pivotal development was the February 2022 launch of their flagship fund, the CrowdStreet REIT I (C-REIT). This marked a strategic move into offering more accessible, diversified investment vehicles, with a minimum investment of $25,000—significantly lower than the typical $250,000 for many private equity funds. The C-REIT aims to provide investors with exposure to 20-25 private opportunistic and value-add commercial real estate projects.

The curation of these projects is guided by CrowdStreet’s experienced investment analysts, who scrutinize demographic and social shifts. Key trends informing these choices include:

- An aging U.S. population driving demand for specialized life sciences and healthcare properties, such as advanced medical research parks or senior living facilities.

- The relentless growth of e-commerce, which continues to fuel an expanding need for 'last-mile' industrial spaces. For example, the proliferation of automated micro-fulfillment centers within urban cores has become a critical component of modern logistics.

- A persistent U.S. housing shortage, creating strong opportunities in build-to-rent communities and multifamily housing. A prime illustration is the planned 'Solana Creek' master-planned community in Arizona, designed specifically for rental living (Urban Land Institute, 2024).

- Ongoing population and job migration to the Sunbelt region, generating diverse opportunities across multiple sectors and regional markets, from new business parks to retail developments.

Beyond the C-REIT, CrowdStreet has continued to introduce new thematic funds, such as the CrowdStreet Build-to-Rent and Multifamily Fund 1, LLC, Series III, and the CrowdStreet Sunbelt Growth Fund I. These funds offer targeted exposure to specific market segments, allowing investors to align their capital with high-conviction trends without the burden of individual deal selection.

Strategic Insights and Investor Empowerment

Investor education and thought leadership are cornerstones of any reputable investment platform. CrowdStreet has significantly invested in this area with its “Office of the Chief Investment Officer (CIO).” This initiative focuses on publishing valuable insights and analyses related to the broader CRE market, providing investors with the knowledge to make informed decisions.

Recent publications from the CIO’s office have delved into critical topics, including the potential effects of geopolitical conflicts on U.S. commercial real estate markets, the implications of Federal Reserve interest rate increases, and which real estate asset classes might offer the strongest hedge against inflation. Such content empowers investors to navigate an increasingly complex economic environment (Brookings Institute, 2024).

Complementing these insights are CrowdStreet’s annual reports, such as their “Best Places to Invest Report.” This report leverages market and investment intelligence from their analysts to pinpoint the most promising CRE investment opportunities. While 18-hour cities remain a consistent focus, the 2022 report saw Austin claim the top spot, with Orlando making a dramatic leap due to renewed tourism. New entrants like San Diego, Fort Lauderdale, San Antonio, and Charleston highlighted evolving market dynamics driven by population shifts and economic growth.

Their 2022 Investment Thesis further explored the future of office and hospitality in a post-pandemic world, alongside the continued expansion of industrial and retail sectors driven by e-commerce. A significant addition was life sciences, acknowledging its superior Net Operating Income (NOI) growth over the past decade. CrowdStreet’s outlook for 2022 projected a more balanced market, poised for broader, albeit moderated, growth, with hospitality entering a recovery cycle and multifamily poised for another record year in pricing.

Prudent Investing: Diligence in a Dynamic Market

The appetite for commercial real estate investment remains robust. CrowdStreet’s 2022 Investor Benchmark Survey revealed that 98% of respondents planned at least one CRE investment that year, with 66% intending to allocate more of their personal portfolio to CRE than in 2021. The majority sought to make 1-3 investments, reflecting a measured yet optimistic approach among experienced investors (National Association of Real Estate Investors, 2023).

Investor preferences aligned with CrowdStreet’s projected opportunities, favoring the Southeast and Southwest U.S. regions—areas experiencing significant demographic and economic expansion. This convergence of investor interest and market opportunity highlights the strategic foresight embedded in platforms like CrowdStreet.

However, the journey of investing, particularly in private markets, requires careful consideration. While platforms like CrowdStreet offer access, individual investors must conduct thorough due diligence, especially when considering individual deals. Understanding the sponsor’s track record, management experience, and the specifics of each project is paramount. For instance, a diversified private real estate fund, like those offered by Fundrise, inherently mitigates concentration risk by spreading capital across numerous assets, offering a layer of protection against the underperformance of any single property or sponsor.

The economic landscape of 2025, marked by the Federal Reserve's interest rate cuts on September 17, 2025, signals a potential end to the commercial real estate recession. This shift is expected to usher in a period of renewed growth over the next three years, making understanding what’s new at CrowdStreet and other leading platforms crucial for strategic positioning. For those who prefer a more hands-off, diversified approach, exploring platforms like Fundrise, which specializes in such funds, remains a highly recommended path for building passive income and long-term returns in real estate.