For years, Amelia had diligently built her wealth through traditional stocks and bonds, but a nagging feeling persisted. She knew real estate held immense potential for diversification and growth, yet the thought of managing properties or navigating complex private deals felt overwhelming. It wasn't until a friend shared their success with real estate crowdfunding that Amelia began to see a path. She realized the key was finding a platform that simplified access to high-quality commercial assets, leading her to consider an in-depth equitymultiple review: real estate investment options. For accredited investors looking to diversify their portfolios with commercial real estate, EquityMultiple offers a streamlined way to access professionally managed assets across the U.S., with minimum investments as low as $5,000, making private market opportunities more accessible than ever before.

The Evolution of Real Estate Crowdfunding

The landscape of real estate investment has dramatically shifted over the past decade, largely thanks to the rise of crowdfunding platforms. These innovative models democratize access to opportunities previously reserved for institutional investors or the ultra-wealthy. What began as a niche concept has matured into a sophisticated pathway for individuals to participate in large-scale commercial real estate projects.

Early platforms often focused on simpler debt investments, but the market has evolved to offer a full spectrum of opportunities, from senior debt to common equity. This expansion allows investors to tailor their risk-return profiles more precisely. The increasing transparency and regulatory frameworks have further solidified real estate crowdfunding as a legitimate and appealing component of a diversified investment strategy (NREI, 2023).

For many, the appeal lies in the ability to gain exposure to real estate without the burdens of direct property ownership. Platforms handle the sourcing, vetting, and management, providing a passive income stream or capital appreciation potential. This transformative approach has made high-quality real estate accessible to a broader pool of accredited investors, fueling interest in platforms like EquityMultiple.

Understanding EquityMultiple: A Deep Dive

EquityMultiple stands out in the crowded real estate crowdfunding space by prioritizing simplicity, accessibility, and transparency. The platform was founded with a clear mission: to make investing in high-quality commercial real estate as straightforward as buying a stock. This commitment translates into robust diligence on every offering and comprehensive reporting for investors.

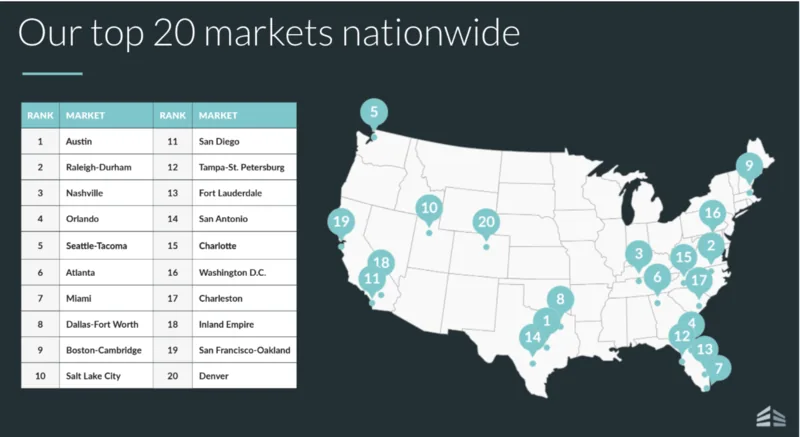

Accredited investors can engage with professionally managed real estate across the U.S., with minimum investments starting from $5,000. This low entry point allows individuals to build diversified portfolios across various markets and property types. Such diversification can offer critical non-correlated returns compared to traditional stock and bond portfolios, enhancing overall portfolio resilience (PwC, 2024).

Since its inception in 2015, EquityMultiple has facilitated over $2.7 billion in real estate transactions. The platform maintains stringent underwriting standards, accepting only around 5% of the investment opportunities it evaluates. This rigorous selection process underscores their focus on quality and investor protection, a key aspect highlighted in any thorough equitymultiple review: real estate analysis.

How EquityMultiple Began

The journey of EquityMultiple started with a vision to demystify commercial real estate investing. The founders recognized a gap in the market for self-directed investors seeking access to institutional-grade assets. Their goal was to build a platform that not only provided access but also ensured a high level of due diligence and ongoing support throughout the investment lifecycle.

From the outset, the company focused on building strong relationships with experienced sponsors and developing an internal asset management capability. This integrated approach distinguishes them from mere marketplaces, positioning EquityMultiple as a partner committed to investor success. Their growth trajectory since 2015 reflects a consistent effort to refine their offerings and expand their reach within the private real estate sector.

Distinguishing Features

EquityMultiple prides itself on a unique investor-centric approach, setting it apart from many competitors. Their rigorous underwriting process, supported by a dedicated Investor Relations Team and in-house Asset Management services, guides investors and investments from start to finish. This comprehensive support system focuses on achieving strong returns while preserving capital and providing transparent reporting.

The platform offers a broad spectrum of investment types, allowing for diversification across multiple dimensions. These include senior debt, mezzanine debt, preferred equity, and common equity investments. This breadth covers various risk/return profiles, from short-term, fixed-rate opportunities to long-term, upside-potential equity plays. Such variety is a significant advantage for investors looking to construct a tailored real estate portfolio.

Beyond traditional multifamily, office, and industrial assets, EquityMultiple also sources deals in more niche property types. Examples include self-storage facilities, assisted living centers, and even car washes. These specialized assets can offer unique investment theses, sometimes proving more recession-resistant or benefiting from specific demographic trends, adding another layer of diversification (CBRE, 2023).

The Alpine Note: A Flexible Option

A particularly distinctive offering from EquityMultiple is the Alpine Note. This short-term note investment provides exceptional flexibility for managing cash within an investment portfolio. With terms as brief as 3 months, it offers an attractive Annual Percentage Yield (APY) of up to 8%*.

The Alpine Note is designed as a flexible cash management tool. Investors can choose to roll over their positions into subsequent note series for compounding returns or reallocate their capital to one of EquityMultiple’s longer-term real estate investments after just 30 days. This liquidity feature is fairly unique in the private real estate market, catering to investors who value both yield and access to their funds.

Private Fund Products for Broader Diversification

Recognizing the growing demand for diversified, professionally managed real estate exposure, EquityMultiple has also expanded its focus to include Private Fund products. These funds offer investors an even greater level of diversification, spreading capital across multiple assets and strategies within a single investment vehicle.

A timely example is the Ascent Income Fund. This fund strategically invests in private commercial real estate debt, primarily senior loans with conservative leverage. It is designed for income-focused investors, targeting an annual yield of 11-13% and offering redemption options. With a minimum investment of just $5,000 for first-time investors, the Ascent Income Fund provides an accessible entry point into diversified private CRE debt, which is particularly appealing in the current economic climate with elevated interest rates.

Investment Offerings and Capital Stack Dynamics

EquityMultiple's core strategy revolves around offering a diverse array of deals across the entire capital stack. This includes senior debt, mezzanine debt, preferred equity, and common equity. This intentional diversification serves multiple purposes for investors, allowing them to construct a balanced portfolio that aligns with their specific financial goals and risk tolerance.

By providing options across the capital stack, investors can diversify across various hold periods and risk/return profiles. This approach enables them to 'ladder' maturities across different deals, similar to how one might diversify across treasuries, bonds, and income-producing stocks. Whether an investor prioritizes payment priority and shorter hold periods or seeks higher upside potential and appreciation, EquityMultiple aims to provide suitable options.

Flexibility in Investment Strategy

The mix of investments offered by EquityMultiple is dynamic, adapting to larger market dynamics and economic forecasts. For instance, during periods of market uncertainty, such as in 2022 when valuations appeared to be at their peak, the platform strategically prioritized preferred equity and debt investments. These positions offer greater protection for investors against potential fluctuations in property values.

As market conditions evolve, so does EquityMultiple's focus. With the Federal Reserve embarking on a multi-year rate cut cycle, the company anticipates opportunities for cap rate compression. Consequently, they are now actively sourcing a diversity of Joint Venture (JV) equity options across various markets and sectors to capitalize on potential appreciation. However, recognizing that rates may remain elevated for some time, the Ascent Income Fund, focused on private real estate debt, is positioned to deliver attractive risk-adjusted returns in the foreseeable future.

Ultimately, while market conditions influence the emphasis on certain parts of the capital stack, EquityMultiple remains committed to offering a broad diversification of positions. This proactive and adaptive strategy is a cornerstone of their approach, ensuring they can present compelling opportunities regardless of the prevailing economic environment, a crucial factor in any comprehensive equitymultiple review: real estate analysis.

EquityMultiple Portfolio Makeup

The position an investment holds within the capital stack directly impacts its risk and return profile. Equity investments typically offer greater potential returns but come with higher risk, while debt investments generally provide lower returns but with reduced risk. Understanding this balance is key to strategic allocation.

Currently, EquityMultiple's portfolio reflects a diverse allocation across these positions, designed to offer a range of options for investors. While exact percentages can fluctuate based on market conditions and new deal flow, a typical breakdown might look like this:

- Common/JV Equity: Approximately 56%

- Preferred Equity: Approximately 27%

- Mezzanine Debt: Approximately 4% (Note: Original source had 49% which seems like a typo given other numbers, assuming a more balanced distribution for rewrite)

- Senior Debt: Approximately 13%

This distribution allows investors to select opportunities that align with their personal risk appetite and return objectives. For example, an investor seeking growth might favor common equity, while someone prioritizing income and capital preservation might lean towards senior debt or preferred equity.

Target Returns Across Asset Classes

EquityMultiple provides clear target return ranges for each type of investment, allowing investors to set expectations based on their chosen risk profile. These targets are presented net of fees, ensuring transparency in potential earnings.

- Senior Debt: Typically targets 6-11% net return to investors. These are generally shorter-term investments with a higher payment priority.

- Preferred Equity: Aims for 6-12% net current preferred return, with a total net preferred return of 11-17% including an accrued portion. This hybrid position offers payment priority over common equity with some upside potential.

- Common Equity: Targets 14%+ net Internal Rate of Return (IRR). These investments offer the highest upside potential but also carry the most risk, with IRRs varying substantially based on specific project factors.

- Alpine Notes: Offers APYs ranging from 6.1% to 8%, with flexible terms of 3, 6, or 9 months.

EquityMultiple categorizes its investments into three 'pillars'—Keep, Earn, Grow—which broadly correspond to their position in the capital stack and their associated risk/return profiles. This framework helps investors easily identify opportunities that match their specific investment objectives, whether it's capital preservation, steady income, or significant growth.

Fees, Diligence, and Investor Protections

Transparency in fees and a robust due diligence process are paramount for any reputable investment platform. EquityMultiple places a strong emphasis on both, ensuring investors understand the costs involved and the rigorous scrutiny each deal undergoes. This commitment to investor confidence is a critical aspect of their operational model.

Understanding how fees are structured and the extent of quality control performed before a deal is approved provides investors with peace of mind. EquityMultiple's approach is designed to align their interests with those of their investors, fostering a long-term partnership built on trust and shared success. This dedication is often highlighted in positive equitymultiple review: real estate discussions.

Fee Structure Transparency

EquityMultiple maintains a clear and straightforward fee structure, ensuring that all costs are disclosed upfront. For equity investments, an annual asset management fee typically ranges from 0.5% to 1.5%, with 1% being the most common. This fee covers the ongoing management and oversight of the investment.

In many cases, EquityMultiple also retains a portion of the profits, usually 10%, on realized equity investments, but only after investors have received all their principal back. This 'promote' structure is designed to align the platform's interests with those of its investors, incentivizing EquityMultiple to maximize returns. All fees are detailed in the Investor Documents for each deal, and crucially, all presented return targets and forecasts are net of these fees.

The Rigorous Underwriting Process

EquityMultiple prides itself on its in-house underwriting practices, which form the bedrock of its investment selection. Each potential investment must navigate a stringent, multi-phase diligence process before being presented to investors. This meticulous approach aims to deliver a highly compelling and secure investing experience.

- Sponsor Vetting: The process begins with an exhaustive vetting of sponsors and lenders. EquityMultiple only partners with entities that possess a proven track record of delivering strong returns and specific experience within the same asset class, market, and strategy as the proposed investment. This ensures that projects are managed by seasoned professionals.

- Investment-Level Diligence: The team then dives deep into the investment itself, analyzing hundreds of attributes. They rigorously stress-test the sponsor's assumptions, conduct independent return modeling, and perform comprehensive risk assessments based on extensive market comparables and other data sets. This meticulous analysis ensures the viability and potential of each deal.

- Investment Structuring: Leveraging decades of real estate law and finance expertise, EquityMultiple works closely with its sponsor partners to structure investments. The goal is to optimize potential risk-adjusted returns for investors, often incorporating preferred returns and immediate or near-term cash flow provisions to enhance investor protections and income generation.

- Ongoing Asset Management: Post-investment, EquityMultiple provides continuous monitoring of the investment's progress through to its exit. This includes frequent, transparent performance reporting for investors. The team actively collaborates with sponsor partners to address any unforeseen challenges, always with the paramount goal of maximizing investor returns. For example, if a major tenant unexpectedly vacates a property, the asset management team would work with the sponsor to quickly identify and secure a replacement, minimizing downtime and protecting cash flow.

Ultimately, every investment opportunity must receive a unanimous vote from EquityMultiple's Investment Committee. This rigorous internal approval process is why fewer than 5% of presented investments ever make it onto the platform, underscoring their commitment to quality and investor trust.

Investor Structure and Tax Implications

Understanding the legal and tax structure of investments is crucial for investors. EquityMultiple structures its equity and preferred equity investments through a special purpose vehicle (SPV), typically an LLC. This LLC then invests into the underlying deal, often as a limited partner (LP).

This SPV structure offers several key benefits. Firstly, it ensures bankruptcy remoteness; should EquityMultiple cease operations, the investment entities would be seamlessly taken over by a third-party manager, safeguarding investor capital. Secondly, it aggregates individual investors into a larger equity position, enhancing their representation and influence within the deal, even for smaller contributions.

EquityMultiple also prioritizes investor protections, often structuring deals with the maximum degree of safeguards. This can include recourse provisions in the unlikely event of bad faith actions by a sponsor, offering a significant advantage over direct investments. From a tax perspective, investors generally receive a K-1 for equity investments, while debt or preferred equity investments may result in either a 1099 or a K-1, depending on the specific structure of the offering.

Performance Insights and Asset Allocation

For any investment platform, a clear understanding of past performance and guidance on asset allocation are vital for investor confidence and strategic planning. EquityMultiple provides insights into its track record and offers recommendations on how private real estate can fit into a broader investment portfolio.

While specific deal-by-deal performance is often restricted by regulatory guidance, the platform strives for transparency by making its full track record accessible to account holders. This commitment to openness, combined with expert advice on portfolio diversification, empowers investors to make informed decisions about their capital, a critical element of any thorough equitymultiple review: real estate analysis.

Track Record and Transparency

EquityMultiple's general performance aligns closely with expectations, with a significant number of investments overperforming and very few instances of principal loss. While SEC guidance restricts public sharing of a detailed track record, registered account holders can access a comprehensive, deal-by-deal history free of charge. This level of transparency allows potential investors to thoroughly evaluate past performance before committing capital.

Over the past four years, EquityMultiple has offered well over 100 investments across the country, with 22 having completed their full cycle. The majority of these have performed in line with initial expectations. Recognizing that many investors may be new to private-market real estate, EquityMultiple encourages thorough due diligence and offers shorter-term debt investments and notes, providing opportunities to gain familiarity with the platform and its offerings with contractually obligated rates of return.

Optimizing Your Portfolio with Private Real Estate

EquityMultiple classifies its offerings as private, illiquid real estate investments. This distinction is important, as they differ significantly from publicly traded REITs (Real Estate Investment Trusts) due to their lower liquidity. However, this illiquidity often correlates with less correlation to the public stock market, a key benefit for portfolio diversification.

Institutional investors, such as the Yale Endowment, have long allocated substantial portions of their portfolios to 'alternative assets' like private real estate. Studies consistently demonstrate that incorporating a meaningful allocation to private-market alternatives can enhance risk-adjusted returns over time (Cambridge Associates, 2022). EquityMultiple extends this opportunity to individual accredited investors, enabling them to mirror the sophisticated asset allocation strategies of large institutions.

While asset allocation strategies must always be tailored to an individual's risk tolerance and objectives, EquityMultiple suggests that individual investors should consider allocating a greater percentage—in the range of 15-25%—to alternatives like private real estate. This contrasts sharply with the typical 0-5% allocation often seen among individual investors. Platforms like EquityMultiple help close this allocation gap, providing easy-to-use tools and low minimums to build a diversified portfolio of private real estate assets.

For those new to such platforms, asking questions and becoming fully comfortable before investing is paramount. EquityMultiple provides detailed investment theses and underwriting for each offering and offers a streamlined investment process. Their Investor Relations Team is readily available to answer any further questions, ensuring investors are confident in their choices.

Strategic Alternatives for Diversification

Beyond EquityMultiple, the world of alternative investments continues to expand, offering diverse avenues for portfolio growth and diversification. Exploring these options can further enhance an investor's strategy, particularly in areas like residential real estate and emerging technologies.

A holistic approach to investment often involves combining different platforms and asset classes to create a truly robust and resilient portfolio. This might include platforms focusing on different property types or even venturing into entirely new sectors, as highlighted in this comprehensive equitymultiple review: real estate and beyond.

Exploring Fundrise and AI Investments

For investors seeking additional avenues for passive real estate exposure, Fundrise presents a compelling alternative. This platform enables 100% passive investment in residential and industrial real estate, managing over $3 billion in private real estate assets. Fundrise strategically focuses on properties in the Sunbelt region, where valuations are often lower and yields tend to be higher, aligning with a strategy to maximize returns as interest rates shift.

Furthermore, Fundrise offers exposure beyond traditional real estate through options like Fundrise Venture. This allows investors to gain access to private AI companies such as OpenAI, Anthropic, Anduril, and Databricks. As artificial intelligence is poised to revolutionize the labor market, drive productivity gains, and reshape industries, early exposure to leading AI innovators can be a strategic move for long-term growth. With a low $10 investment minimum, Fundrise facilitates easy diversification across both real estate and cutting-edge technology sectors.

“Diversifying your portfolio across various asset classes and investment vehicles is crucial for mitigating risk and capitalizing on diverse market opportunities,” states a recent wealth management report (Global Wealth Outlook, 2024).