When Mark and Emily celebrated their 30th birthdays, they felt on top of the world. Their careers were flourishing, they'd just bought their first home, and dreams of starting a family were finally becoming a reality. This pivotal moment, full of new responsibilities, highlighted a crucial financial step they hadn't yet taken: securing life insurance. While no single age fits everyone, around age 30 is generally considered the best age to get life insurance. This strategic timing often coincides with significant life milestones like starting a family and homeownership, making it ideal for locking in favorable rates and providing essential financial security for loved ones.

The Sweet Spot: Why Age 30 Is Optimal

Life is a complex journey, filled with unpredictable turns. Every financial decision, including when to secure life insurance, involves a degree of foresight and risk assessment. While perfection is elusive, aiming for optimal timing can significantly benefit your long-term financial health. For many, around age 30 represents this optimal window for life insurance.

This recommendation isn't arbitrary; it's rooted in several key life stages that typically converge around this decade. By aligning your insurance purchase with these milestones, you can secure crucial protection when it matters most, often at the most advantageous rates. It's about proactive planning, not reactive scrambling.

Family Planning: The Arrival of Dependents

One of the most compelling reasons to consider life insurance around age 30 is the likelihood of starting a family. The average age for first-time mothers in America is approximately 26, while for fathers, it's around 31 (Mayo Clinic, 2023). This demographic trend places many individuals squarely in their late twenties or early thirties when children enter their lives.

Ideally, securing life insurance a year before having children offers maximum peace of mind. For instance, consider a couple, David and Sarah, who married at 28. They planned to start a family in their early thirties. By purchasing a policy at 29, they locked in excellent rates before any potential health changes or the immediate financial strain of a newborn. This foresight meant their growing family was protected from day one.

Homeownership: Protecting Your Biggest Asset

Beyond family, buying a home with a mortgage often becomes a reality in your early thirties. According to industry reports, the median age for a first-time homebuyer is around 33 (Economic Studies, 2024). A substantial mortgage represents a significant financial obligation that could become a burden for loved ones if something were to happen to the primary income earner.

Imagine a scenario where a young professional, Maria, bought her dream home at 32 with a substantial mortgage. She wisely purchased a life insurance policy beforehand. Tragically, a few years later, she passed away unexpectedly. Her policy allowed her partner to pay off the mortgage, preventing the stress of losing their home during an already difficult time. This underscores why getting life insurance around age 30, before or concurrently with a mortgage, is a prudent decision.

Career and Income Stability

By age 30, many individuals have established their careers and achieved a greater degree of income stability. This makes it easier to afford and commit to a life insurance policy. Earlier in your twenties, income might be lower, and financial priorities might be different, making a significant insurance commitment feel premature. However, by your third decade, a clearer financial picture often emerges, allowing for more deliberate planning.

The Cost Advantage: Younger Means Cheaper

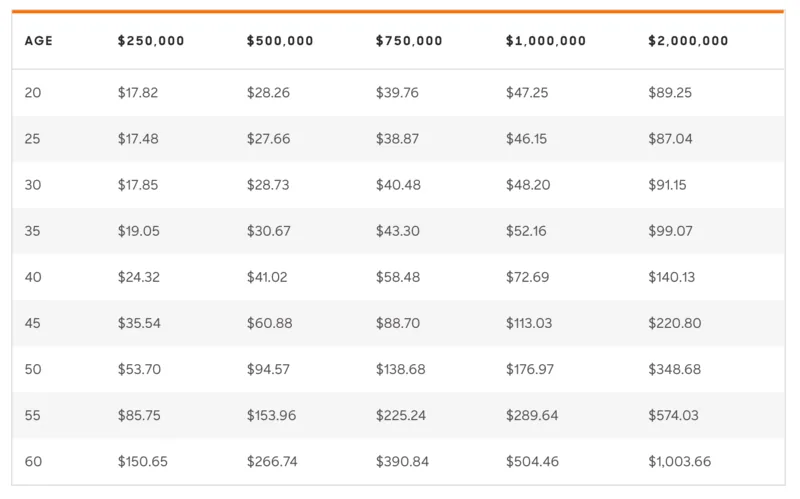

One of the most straightforward arguments for getting life insurance when you're younger is the significant cost savings. Life insurance premiums are primarily determined by age and health. Younger individuals are generally healthier and have a longer life expectancy, presenting a lower risk to insurance providers. This translates directly into more affordable rates.

Data consistently shows a gradual increase in premiums with age. For example, a 30-year-old man typically pays significantly less for a comparable policy than a 45-year-old man. What's particularly noteworthy is that the average monthly premium at age 30 often remains quite similar to that at age 20. This means your twenties can be considered a "grace period" for life insurance, allowing you to defer the cost without a substantial penalty if you wait until 30.

However, this affordability window begins to close rapidly after your mid-thirties. The increase in premiums becomes more noticeable, making age 30 the sweet spot to lock in excellent rates before costs escalate. Locking in a 30-year term policy at age 30 is akin to securing a fixed-rate mortgage when interest rates are historically low; you benefit from that favorable rate for a long duration, unaffected by future market changes or personal health shifts.

Long-Term Security: Aligning with Financial Milestones

When considering the duration of your life insurance policy, thinking about your long-term financial goals can provide valuable guidance. A 30-year term policy initiated at age 30 often aligns perfectly with several critical financial milestones, providing coverage until you are likely financially secure enough to self-insure.

Retirement Account Access at 59.5

For many Americans, a primary financial goal is to accumulate sufficient wealth in tax-advantaged retirement accounts, such as 401(k)s and IRAs, which become accessible without penalty at age 59 and a half. A 30-year term policy taken out at age 30 would cover you until age 60, neatly bridging the gap until these significant assets become available. By this point, a robust retirement portfolio, combined with other investments, often negates the need for traditional life insurance.

For instance, an entrepreneur, Alex, started his business at 28. He knew his initial years would be financially tight, but by 30, with a stable income, he secured a 30-year term policy. This ensured his family's protection through his peak earning years and until his substantial business assets and retirement funds matured, allowing him to eventually let the policy lapse without worry.

Social Security Eligibility at 62+

Another benchmark is the eligibility for Social Security benefits, which currently begins at age 62. By your early sixties, it's generally expected that major debts like mortgages are paid off, and children are independent adults. Having life insurance coverage until this point ensures that your family's financial well-being is safeguarded during the years when they are most reliant on your income.

A Personal Lesson: The Cost of Delay

The journey to optimal life insurance coverage is often fraught with hindsight. Many individuals, including seasoned financial planners, have faced situations where earlier action would have yielded better outcomes. The common thread is underestimating future needs and the rising cost of delay.

One common regret is not securing a sufficiently long-term policy early on. For example, opting for a 10-year term policy at age 28 might seem adequate initially. However, as life evolves with marriage, children, and larger homes, renewing that policy later can reveal a stark increase in premiums. A 30-year term chosen at age 28 or 30 would have locked in a far lower rate for a much longer, crucial period.

The cost of renewal can be shocking. It's not uncommon for premiums to jump significantly, sometimes by 7-10 times, due to increased age and any new health conditions that have emerged. This experience serves as a powerful reminder: the time to get life insurance is often before you absolutely "need" it, when rates are most favorable and your health is at its best.

The Impact of Health Changes

Medical history plays a critical role in life insurance underwriting. Any new diagnosis or even a comprehensive health check-up that uncovers minor issues can significantly impact your premium rates. Once a condition is noted in your medical records, it's virtually impossible to reverse its effect on future insurance applications.

Consider the case of a professional who, at 36, decided to get a sleep study for snoring. While seemingly innocuous, the clinic's extensive testing led to a mild sleep apnea diagnosis. Years later, when seeking new life insurance, this diagnosis, even if minor and well-managed, contributed to dramatically higher premium quotes. This highlights the importance of securing a policy when you are in prime health, ideally before any unforeseen medical explorations.

Proactive Planning: Smart Decisions for Life Insurance

When it comes to life insurance, having slightly more coverage than you think you need is generally a safer bet than having too little. Policies offer flexibility; you can often reduce coverage or cancel a term policy at any point without penalty. However, increasing coverage typically requires a new underwriting process, meaning new health evaluations and potentially higher rates.

This flexibility offers significant optionality value. If your financial situation improves dramatically, you might decide you no longer need the full coverage and can cancel. Conversely, if you face unexpected health challenges or increased financial responsibilities, maintaining that locked-in, affordable rate for a longer term provides invaluable security.

Therefore, getting a 30-year term life insurance policy around age 30 is a strategically sound decision. It allows you to secure the lowest possible rate for the period when you're most likely to have significant financial obligations and dependents, providing peace of mind and adaptability as life unfolds.

Shopping for Coverage: Maximizing Value

Many consumers mistakenly believe that loyalty to an existing insurance carrier guarantees the best rates. However, the insurance market is highly competitive, and shopping around is essential to ensure you're getting the most value for your money.

Online comparison platforms have revolutionized how consumers access life insurance quotes. These platforms allow you to compare customized rates from multiple carriers in one place, often revealing significant savings. It's not uncommon for individuals to find policies that are 40-50% cheaper than what their long-standing insurer offers for similar coverage.

For instance, a couple might have used the same insurer for auto and home policies for decades, assuming they were receiving the most competitive rates. When they decided to shop for life insurance, they discovered that an independent comparison yielded a policy with a different carrier that was substantially more affordable. This experience underscores the importance of regularly reviewing all your insurance policies--life, auto, and homeowners--every few years to ensure you're not overpaying.

Making the Right Choice for Your Family

The decision to get life insurance is fundamentally about anxiety management and alleviating the "what-if" pressures that come with life's responsibilities. For parents, in particular, juggling health, education, career, and finances creates immense stress. Knowing that your family is financially protected, should the unthinkable occur, can provide profound peace of mind.

In conclusion, while individual circumstances vary, if a single age had to be chosen, the best age to get life insurance is unequivocally 30. Securing a 30-year term policy at this age provides a crucial buffer, locking in affordable rates for the most financially demanding period of your life. This strategic move offers the invaluable option to adapt your coverage as your needs evolve, ensuring your loved ones are always protected.

The second best age to get life insurance is the year before you anticipate having children. The immediate motivation and responsibility that comes with parenthood will solidify your commitment to protecting your family's future.

Think of it like locking in a 30-year fixed-rate mortgage when interest rates are at historic lows. Over time, the affordability of your fixed premium will become a quiet marvel, providing consistent security amidst inflation and growing wealth. Unlike a mortgage, shopping for life insurance carries no origination fees, making it a risk-free endeavor to explore your options and secure the best possible rates for your family's future (Harvard, 2024).