Midlife

The Complete Guide to Midlife Stress in Boomers

When it comes to midlife, it’s not all red sports cars and cliché crises. The real boomers need worry are those entering their 50s with thinning financial safety nets, rising stress, and limited support. The good news: there are clear, practical ways to protect your mental health and future well-being.

This guide breaks down who’s truly at risk, what the research is telling us, and how to take action now—without panic, shame, or overwhelm.

Why This Really Matters in Your 40s and 50s

Midlife is no longer the guaranteed “crisis zone” it was once portrayed to be. But for a specific group of adults—especially lower and lower-middle-income boomers—mental health and life satisfaction are under real pressure.

Here’s the core problem:

A growing segment of 50-somethings is facing high stress, poor health, and unstable finances at the exact stage when resilience and security should be rising.

This guide will show you how to spot if you’re in that at-risk group, what’s driving the pressure, and the proven steps you can take to regain control.

What You’ll Learn (Clear Outcomes)

By the end, you’ll know how to:

- Identify whether you’re in the boomer group we genuinely need to worry about.

- Understand how income, health, and age interact (without the myths).

- Use simple, research-aligned habits to stabilize your mental health.

- Make realistic financial and lifestyle shifts in your 40s–60s.

- Advocate for yourself using available programs and supports.

Prerequisites: What You Need Before You Start

You do NOT need perfect finances or perfect habits.

You’ll get the most value if you:

- Are between 40 and 74, or care for someone who is.

- Are willing to look honestly at your stress, health, and money.

- Can commit to small, consistent changes rather than dramatic overhauls.

Who Are the Boomers We Need to Worry About?

The phrase "boomers need worry" isn’t about shaming a generation. It’s about clarity.

The most vulnerable group, based on recent large-scale U.S. data, tends to be:

- Adults roughly 50–59.

- In the low or lower-middle income brackets.

- Managing multiple stressors: caregiving, health issues, unstable work, or debt.

These individuals are more likely to report high levels of psychological distress, poor daily functioning, and fear about retirement prospects. The risk is less about turning 50 and more about doing it without a safety net.

What the Science Actually Shows (In Plain English)

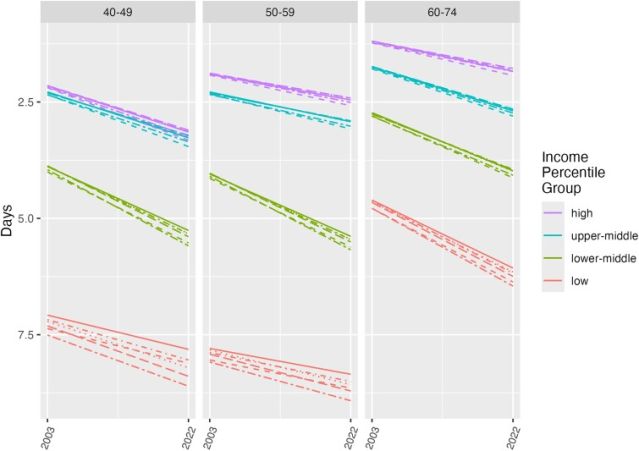

A major analysis led by Stanford researchers used nearly two decades of survey data (5.3 million adults, ages 43–74) to map how age, income, and health intersect. Their findings challenge the classic midlife crisis story.

Key insights:

- Age alone is not the villain. Well-being did not universally collapse in midlife.

- Income strongly shapes mental health. Those in the lowest income brackets—especially in their 50s—reported the worst mental and physical health.

- Later life can improve. Many lower-income adults reported better well-being after 60, likely aided by Medicare, Medicaid, and Social Security access (Rehkopf et al., 2025).

The most concerning line in the data: adults in their 50s, in the lowest income group, with consistently poor self-rated mental health.

This aligns with broader findings from respected institutions (including Harvard, 2024) that long-term financial strain, discrimination, chronic illness, and high stress increase the risk of depression, anxiety, and so-called “deaths of despair.”

Quick Definition (Featured Snippet Style)

A high-risk midlife profile is:

- Age 50–59.

- Low or unstable income.

- Ongoing stress (health, caregiving, work, or debt).

- Limited access to affordable healthcare or support.

If this describes you or someone you love, this is where to focus.

How to Protect Your Mental Health in Midlife

Step 1: Run a Gentle Self-Check

Take 5 minutes to scan your last 30 days. Have you often felt:

- Exhausted, numb, or unusually irritable?

- Hopeless or stuck about money or the future?

- Disconnected from friends, family, or activities?

If “yes” shows up often, treat it as data—not failure. The boomers need worry most are often the ones minimizing their symptoms.

Step 2: Normalize Getting Help

Therapy and support are not luxuries.

Research from U.S. public health agencies shows millions of midlife adults with untreated mental health challenges. Consider:

- Talking to your primary care provider about mood, sleep, and stress.

- Using sliding-scale counseling, telehealth, or community mental health centers.

- Exploring employer assistance programs if available.

Step 3: Build a Daily Stability Routine

You don’t need an idealized morning routine. You need a stabilizing one.

Try this 4-part foundation:

- 5–10 minutes of movement upon waking.

- One intentional meal choice (high protein / high fiber).

- A fixed wind-down time (screens off 30 minutes before bed).

- One micro-connection (text, call, or brief check-in with someone you trust).

These habits regulate your nervous system and improve resilience—especially under financial stress.

Step 4: Reduce Hidden Mental Drains

Look for small leaks that quietly erode your mental health:

- Doom-scrolling financial or political news late at night.

- Comparing your life to peak-moment social media posts.

- Saying yes to every request because you “should be able to handle it.”

Replace one drain with one supportive habit at a time.

Financial Stress: Practical Moves for the Next 10–20 Years

For many boomers, the need worry comes from one place: “Will I be okay later?” You can’t fix everything overnight, but you can shift from fear to strategy.

Step 5: Get Clear on Your Starting Point

List three numbers:

- What you own (savings, home equity, retirement accounts).

- What you owe (credit cards, loans, medical debt).

- What comes in monthly (after tax) vs what goes out.

No judgment—clarity is your first protective factor.

Step 6: Make One Smart, Sustainable Adjustment

Instead of extreme budgeting, focus on small wins:

- Renegotiate one bill (insurance, phone, internet).

- Automate even a tiny transfer into savings.

- If eligible, explore tax credits or benefits you’re not using.

These micro-moves compound, especially over 5–10 years.

Step 7: Align Work With Longevity

Think of your 50s not as an ending, but a bridge.

Consider:

- Reskilling for roles less physically demanding.

- Negotiating flexible or hybrid arrangements to reduce burnout.

- Turning a stable side income (consulting, tutoring, craftsmanship) into a buffer.

This is not about “hustle forever.” It’s about designing work that you can sustain without breaking your health.

Troubleshooting: Why You Still Feel Overwhelmed

If you’re trying to improve things and still feel stuck, you’re not failing—there are common friction points.

Problem 1: “I know what to do, but I can’t make myself do it.”

Possible causes:

- Burnout, mild depression, or chronic stress.

- All-or-nothing thinking: if it’s not perfect, it doesn’t count.

Try this:

- Scale goals down to “laughably small” steps.

- Celebrate completion, not intensity: 3 minutes of walking beats 0.

Problem 2: “I’m ashamed I’m here at this age.”

Shame keeps the most vulnerable boomers silent.

Reframe:

- You’re operating in a system with rising costs, volatile work, and caregiving demands.

- Seeking help is a strategic move, not a confession of failure.

Problem 3: “Everything feels urgent.”

When everything is urgent, nothing moves.

Use a simple filter:

- Can this be done in under 10 minutes? Do it.

- Will this significantly reduce stress in 30 days? Prioritize it.

- If neither, park it for review later.

Advanced Strategies for a Stronger Second Half of Life

Once you’ve stabilized the basics, you can build more intentional fulfillment.

1. Design a Protective Social Network

Intentional connection is a strong buffer against despair.

- Host a simple monthly coffee with neighbors or friends.

- Join one community group (library, faith, volunteer, hobby).

- Create a “mutual support circle” for rides, check-ins, and resources.

2. Use Policy and Programs Strategically

Many boomers need worry less once they understand what support they can access.

Examples:

- Investigate health coverage options that lower out-of-pocket costs.

- Understand eligibility timelines for government benefits.

- Seek nonprofit or community organizations that offer guidance on debt, housing, or caregiving.

3. Protect Against the “Quiet Risks”

Subtle factors that erode midlife well-being:

- Untreated sleep apnea or chronic pain.

- Heavy alcohol use framed as “normal stress relief.”

- Social isolation disguised as “I’m just busy.”

Addressing these can dramatically improve quality of life in your 50s and beyond.

FAQ: Common Questions About Midlife, Money, and Mental Health

Are all boomers in their 50s at risk?

No. The boomers we need to worry about most are those facing sustained financial strain, unstable work, or health barriers. Higher-income individuals tend to maintain or improve well-being into later years.

Is the classic “midlife crisis” real?

Large-scale research suggests there is no universal, dramatic midlife breakdown. Instead, stress is concentrated among specific groups whose challenges are structural, not just emotional.

Why do some people feel better after 60?

For many in lower income brackets, access to programs like Medicare, Medicaid, and Social Security reduces pressure and improves stability, which can lift mood and functioning compared to their 50s.

What’s one change I can make this week?

Choose one: schedule a health or mental health check-in, review a single bill or account, or reach out to one person you trust and tell them honestly how you’ve been.

When should I seek professional help?

Seek help promptly if you notice persistent sadness, loss of interest, thoughts of self-harm, escalating substance use, or if daily functioning feels like a constant uphill battle. Early intervention is a sign of strength—and a proven protective factor.

The real message: not all midlife boomers need worry—but some absolutely do, and for valid reasons. By understanding the risks and acting with intention, you can rewrite the story of your 50s and beyond into one of stability, agency, and quiet confidence.